Let's Connect - (501) 991-4003

INVESTORS

Are you interested in entering the Real Estate Market to Generate Substantial Returns on your Hard-Earned Money?

Are you interested in entering the Real Estate Market to Generate Substantial Returns on your Hard-Earned Money?

If you'd like to explore further details about Marla Buys Properties, including our activities and investment prospects as collaborative partners in deals, purchasing wholesale properties, or if you seek an alternative to investing in the stock market or other conventional avenues, kindly complete the brief information form provided below or contact us directly at (501) 991-4003 . We will gladly provide you with information on the various options available.

We will provide you with details about our company and initiate a conversation to discuss your objectives, demonstrate our activities, and determine if there is a compatibility.

This is neither a solicitation nor an offer of securities. The opportunity to invest in Marla Buys Properties is exclusively available to qualified investors through a written Investment Agreement or Private Placement Memorandum.

Interested In Learning More? Submit Your Info Below or give us a call today at (501) 991-4003.

What Is Private Money Lending?

What Is Private Money Lending?

A private money loan refers to a loan provided to a real estate investor, with the real estate serving as collateral. Private money investors are granted a first or second mortgage, which secures their legal stake in the property and protects their investment. Whenever we identify a property significantly below market value, we offer our private lenders the chance to finance the purchase and renovation of the property. This allows the lender to earn remarkably high interest rates, surpassing those attainable through bank CDs and other conventional investment schemes by four or five times.

In essence, private money lending offers you the chance to assume the role of a bank, enjoying the same profits that banks typically do. It presents an excellent avenue for generating cash flow and establishing a reliable income stream. Moreover, it offers outstanding security and safety for your principal investment. By engaging in private money lending, you can engage in a strategy that has long been employed by banks, earning profitable returns on investments supported by real estate. It is a unique investment opportunity that stands apart from any other vehicle.

How Are Investors Protected?

Imagine placing yourself in the role of a bank by directing your investment capital, including retirement funds, towards securely backed real estate mortgages. Mortgages offer utmost safety since, in the event of default, the bank (in this case, you) can recoup the investment as the primary lien holder on the property.

Before purchasing any property, each one undergoes a thorough evaluation process to assess its profitability. Our aim is to make prudent investment choices, ensuring sound decision-making. To safeguard your interests, we provide you with the following protections:

Mortgage or deed of trust is recorded at the courthouse

Fire and hazard insurance on property

To guarantee the property's legal ownership, we perform a comprehensive title search to ensure its freedom from encumbrances. For rental investments with long-term financing, we always maintain hazard insurance on the property. As a mortgagee, you will be listed, and we will notify you promptly if the insurance is not kept up to date. In the event of any property damage, insurance proceeds would be utilized for property rebuilding, repairs, or repayment to you.

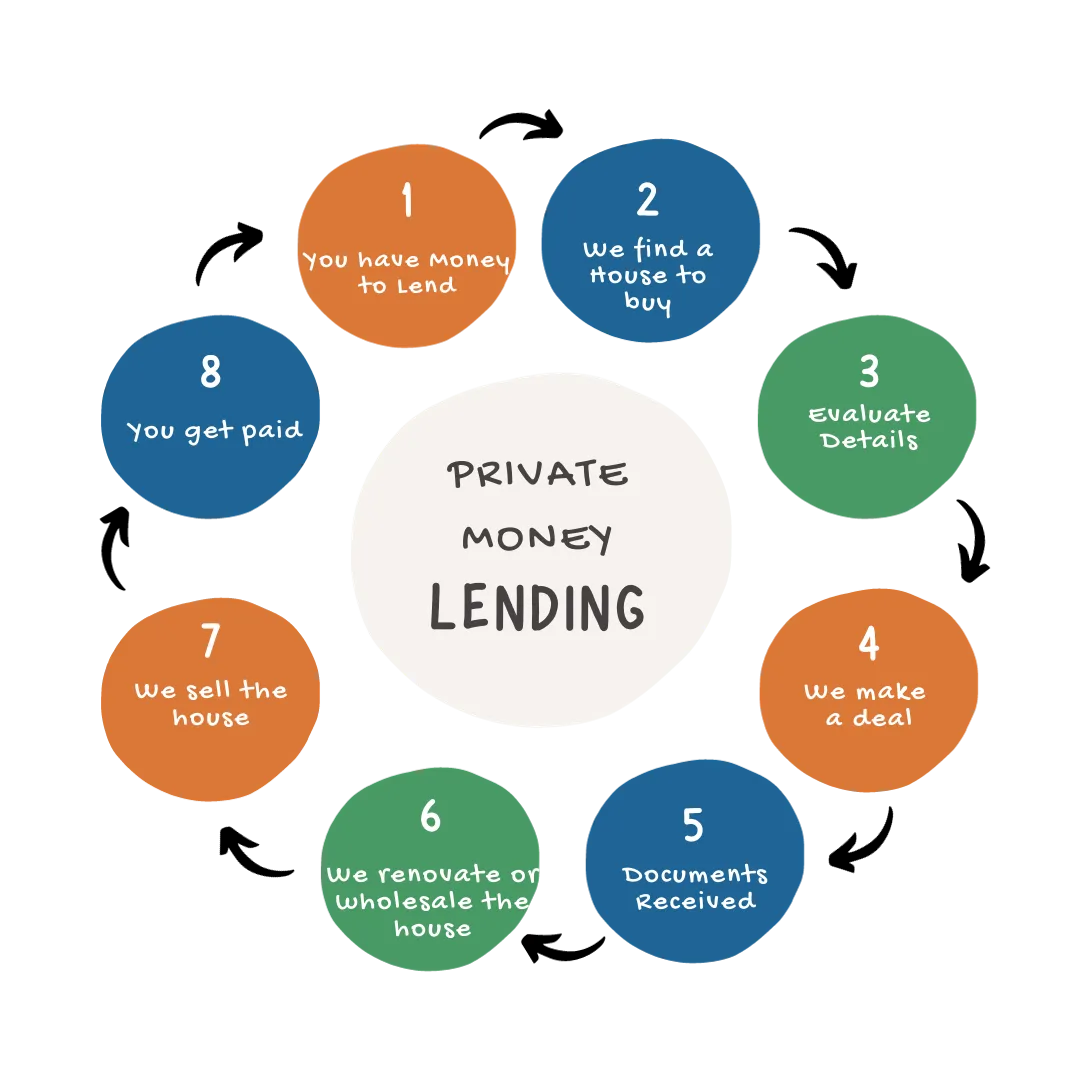

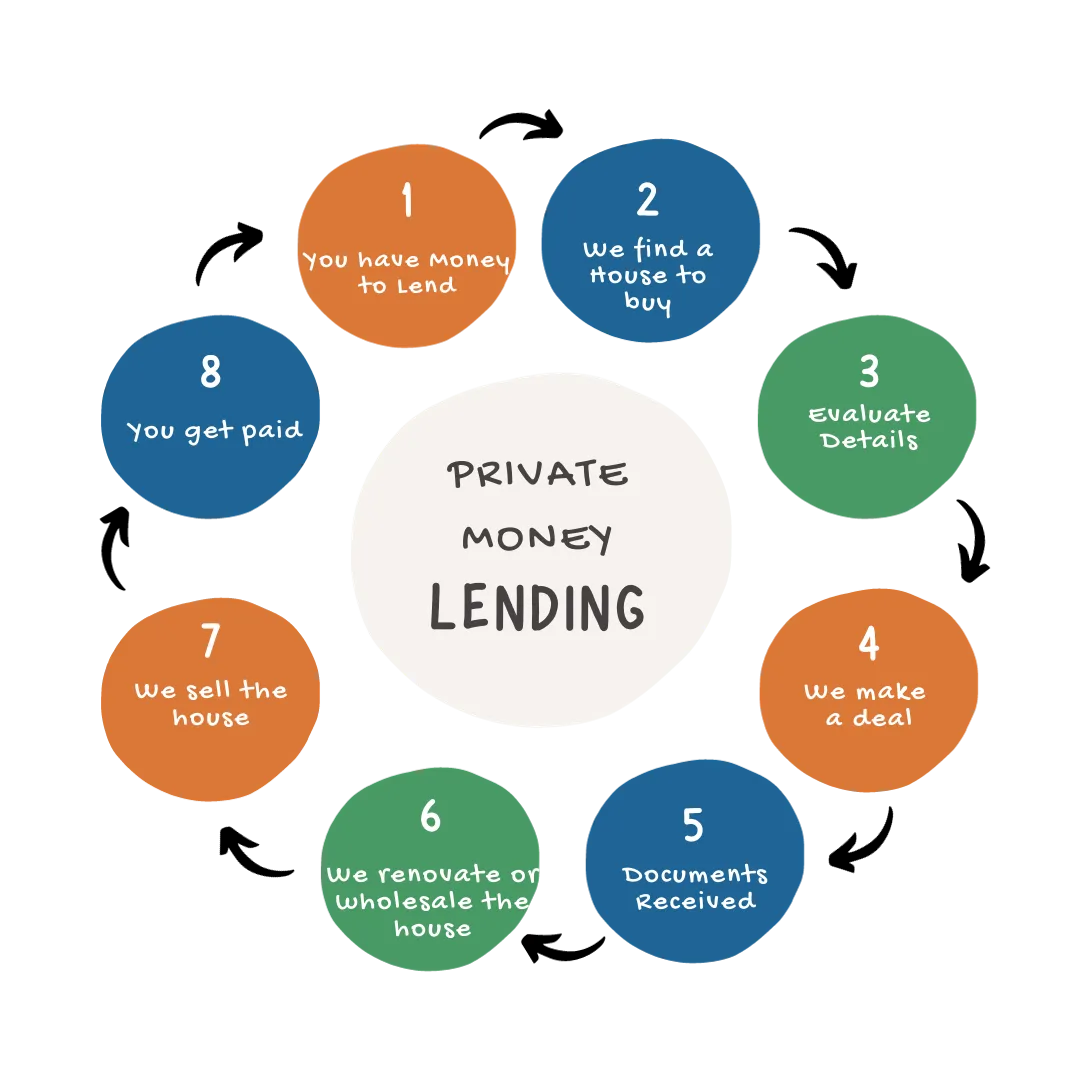

The Private Lender Process

OUR

APPROACH

Our strategy involves acquiring distressed properties that are significantly below their market value, often ranging from 35% to 55% below the After Renovation Value (ARV). These properties undergo renovation in some cases and are subsequently sold to retail buyers and landlords. In other instances, they are wholesaled to other rehabbers, investors, and wholesalers.

Our Due

Diligence

Our team adheres to rigorous guidelines to guarantee that the properties we acquire generate excellent returns for both our company and investors. Each property we identify undergoes an extensive due diligence process, meticulously evaluating various criteria, such as:

Location - Every property acquisition shall find its place amidst thriving market hubs, where the currents of high purchase volumes flow abundantly.

School District - We deeply recognize the significance of a school district in the decision-making process when buyers have children, acknowledging its pivotal role in shaping their educational journey.

CMA - Our team conducts a comprehensive Comparative Market Analysis (CMA), ensuring a thorough evaluation of market dynamics and trends.

Purchase Price based Upon % of ARV [After Repair Value]

Condition - The holistic assessment of the property encompasses its overall condition, encompassing the evaluation of mechanical systems, structural integrity, and more.

How Marla Buys Properties Buys Real Estate:

Equity is inherent in our home purchase approach, where we acquire properties at a substantial discount, ranging from 30-70% below retail value. This instant equity upon purchase results from eliminating intermediaries, such as commissions, mortgage broker fees, loan fees, and reduced attorney costs due to streamlined review processes in typical transactions.

Thanks to our strategic buying approach, we have the capability to present our buyers with fully renovated homes priced at or below the prevailing market rates in the neighborhood. We are selective in our choices, rejecting numerous "close" deals that fail to meet our specific buying criteria. We firmly believe in purchasing properties that make sense for all parties involved.

Think About It...

Do you want to make extra money?

Do you have under performing investments?

Do you invest in the stock market?

Do you have cash?

Do you have interest in real estate but don’t want the hassle?

Four Easy Steps to Invest

A private money loan refers to a loan provided to a real estate investor, with the real estate serving as collateral. Private money investors are granted a first or second mortgage, which secures their legal stake in the property and protects their investment. Whenever we identify a property significantly below market value, we offer our private lenders the chance to finance the purchase and renovation of the property. This allows the lender to earn remarkably high interest rates, surpassing those attainable through bank CDs and other conventional investment schemes by four or five times.

In essence, private money lending offers you the chance to assume the role of a bank, enjoying the same profits that banks typically do. It presents an excellent avenue for generating cash flow and establishing a reliable income stream. Moreover, it offers outstanding security and safety for your principal investment. By engaging in private money lending, you can engage in a strategy that has long been employed by banks, earning profitable returns on investments supported by real estate. It is a unique investment opportunity that stands apart from any other vehicle.

How Are Investors Protected?

Imagine placing yourself in the role of a bank by directing your investment capital, including retirement funds, towards securely backed real estate mortgages. Mortgages offer utmost safety since, in the event of default, the bank (in this case, you) can recoup the investment as the primary lien holder on the property.

To guarantee the property's legal ownership, we perform a comprehensive title search to ensure its freedom from encumbrances. For rental investments with long-term financing, we always maintain hazard insurance on the property. As a mortgagee, you will be listed, and we will notify you promptly if the insurance is not kept up to date. In the event of any property damage, insurance proceeds would be utilized for property rebuilding, repairs, or repayment to you.

Before purchasing any property, each one undergoes a thorough evaluation process to assess its profitability. Our aim is to make prudent investment choices, ensuring sound decision-making. To safeguard your interests, we provide you with the following:

Mortgage or deed of trust is recorded at the courthouse

Fire and hazard insurance on property

To guarantee the property's legal ownership, we perform a comprehensive title search to ensure its freedom from encumbrances. For rental investments with long-term financing, we always maintain hazard insurance on the property. As a mortgagee, you will be listed, and we will notify you promptly if the insurance is not kept up to date. In the event of any property damage, insurance proceeds would be utilized for property rebuilding, repairs, or repayment to you.

Define your investment goals: Amount, Time Frame, Payment Terms.

Position you funds for availability

Receive details of investment opportunity

The Private Lender Process

Wire funds for closing

Investment Process

Our investment process is straightforward. We begin by identifying an exceptionally undervalued property that we intend to purchase. Upon your approval, we will secure the necessary funds from you to acquire and renovate the property. During the closing, you will receive important documents, including a mortgage on the home. The subsequent step involves renovating the property, which typically takes around 3-6 months, depending on the project's scale. Once the renovations are finished, we will list and sell the property. When the closing takes place, you will receive your principal amount along with a 10% interest payment. It truly is that simple! Our aim is to consistently generate substantial profits for you by reinvesting your funds and fostering a long-term, mutually beneficial relationship.

Over time, we have built a strong reputation and forged valuable relationships with a wide range of entities, including local and national banks with REO departments, asset management companies and groups, auction houses, probate and divorce attorneys, as well as an extensive network of investors who may be considering retiring and seeking to liquidate their assets.

OUR

APPROACH

Our strategy involves acquiring distressed properties that are significantly below their market value, often ranging from 35% to 55% below the After Renovation Value (ARV). These properties undergo renovation in some cases and are subsequently sold to retail buyers and landlords. In other instances, they are wholesaled to other rehabbers, investors, and wholesalers.

Our team adheres to rigorous guidelines to guarantee that the properties we acquire generate excellent returns for both our company and investors. Each property we identify undergoes an extensive due diligence process, meticulously evaluating various criteria, such as:

Location - Every property acquisition shall find its place amidst thriving market hubs, where the currents of high purchase volumes flow abundantly.

School District - We deeply recognize the significance of a school district in the decision-making process when buyers have children, acknowledging its pivotal role in shaping their educational journey.

CMA - Our team conducts a comprehensive Comparative Market Analysis (CMA), ensuring a thorough evaluation of market dynamics and trends.

Purchase Price based Upon % of ARV [After Repair Value]

Condition - The holistic assessment of the property encompasses its overall condition, encompassing the evaluation of mechanical systems, structural integrity, and more.

OUR DUE

DILIGENCE

How Marla Buys Properties Buys Real Estate:

Equity is inherent in our home purchase approach, where we acquire properties at a substantial discount, ranging from 30-70% below retail value. This instant equity upon purchase results from eliminating intermediaries, such as commissions, mortgage broker fees, loan fees, and reduced attorney costs due to streamlined review processes in typical transactions.

Thanks to our strategic buying approach, we have the capability to present our buyers with fully renovated homes priced at or below the prevailing market rates in the neighborhood. We are selective in our choices, rejecting numerous "close" deals that fail to meet our specific buying criteria. We firmly believe in purchasing properties that make sense for all parties involved.

If you would like to explore further information regarding Marla Buys Properties, including our operations and investment opportunities as partners on properties or the purchase of wholesale properties, kindly click the button to schedule a call below. We would be happy to provide you with details about the various options we offer.

Think About It...

Do you want to make extra money?

Do you want to make extra money?

Do you have under performing investments?

Do you invest in the stock market?

Do you have cash?

Do you have interest in real estate but don’t want the hassle?

Four Easy Steps to Invest

Define your investment goals: Amount, Time Frame, Payment Terms.

Position you funds for availability

Receive details of investment opportunity

Wire funds for closing

Investment Process

Our investment process is straightforward. We begin by identifying an exceptionally undervalued property that we intend to purchase. Upon your approval, we will secure the necessary funds from you to acquire and renovate the property. During the closing, you will receive important documents, including a mortgage on the home. The subsequent step involves renovating the property, which typically takes around 3-6 months, depending on the project's scale. Once the renovations are finished, we will list and sell the property. When the closing takes place, you will receive your principal amount along with a 10% interest payment. It truly is that simple! Our aim is to consistently generate substantial profits for you by reinvesting your funds and fostering a long-term, mutually beneficial relationship.

Over time, we have built a strong reputation and forged valuable relationships with a wide range of entities, including local and national banks with REO departments, asset management companies and groups, auction houses, probate and divorce attorneys, as well as an extensive network of investors who may be considering retiring and seeking to liquidate their assets.

If you would like to learn more about working with Marla Buys Properties, kindly click the button below to schedule a call. We would be happy to provide you with details about the various options.